Dealer Hits On Soft 17 Good Or Bad

- Dealer Hits On Soft 17 Good Or Bad For You

- Dealer Hits On Soft 17 Good Or Bad Guys

- Dealer Hits On Soft 17 Good Or Bad

- Dealer Hits On Soft 17 Good Or Bad Credit Loans

For example, a table where the dealer hits soft 17 is worst for a player than if the dealer stands on soft 17. Blackjack players should know which rules are player-friendly and which favor the house, and then scout the tables to find the best set of player-friendly rules.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

- However most hit on a soft 17 (that's what you asked in the title). I was actually surprised recently to find a table where they still stayed on soft 17. It will say on the table, usually in the felt near the insurance area. If the table says something like 'Dealer says on all 17s', then the dealer stays on hard and soft 17s.

- Most games of blackjack require the dealer to stop at 17, even if this means the dealer loses, but the rules may allow for the dealer to hit on a soft 17, which is a 17 made with an ace (the ace can be a one or an 11).

- If you happen to be dealt a soft 16 (like Ace-5), you should never surrender and you should never stand. Your first option is to double but only if the dealer shows a weak 4, 5, or 6 upcard. If not, then hit. Finally, we have a pair of 8’s. The correct basic strategy play is to always split the 8’s no matter what the dealer shows.

- CASINO SCENE: The good, bad and ugly of double-deck blackjack By John G. Brokopp Times Correspondent Feb 17, 2012. A figure that's inflated because the dealers hit soft–17.

Dealer Hits On Soft 17 Good Or Bad For You

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

If you’ve applied for financing or other credit and the lender checked your credit scores as part of the process, you’ve probably experienced what’s called a hard credit inquiry.

When lenders check your credit with a hard inquiry (also known as a “hard pull”), they often make a note of their official review in your credit reports. They use that information to assess how you’ve handled credit in the past, how often you’ve paid your debts and bills on time, and whether you have any derogatory marks on your credit reports.

They also want to know how much credit you’re juggling and how long you’ve been managing your credit. All of these factors help creditors decide whether to extend new credit to you or give you additional credit.

You can help yourself prepare for a hard credit pull by monitoring your credit reports and making sure there aren’t any unpleasant surprises. Checking your own credit reports often involves what’s known as a soft credit inquiry, or “soft pull.”

Let’s take a deeper look at the differences between hard credit inquiries and soft credit inquiries.

What is a hard inquiry?

Hard inquiries (also known as “hard pulls” or “hard credit checks”) generally occur when a financial institution, such as a lender or credit card issuer, checks your credit when making a lending decision. They commonly take place when you apply for a mortgage, loan or credit card, and you typically have to authorize them.

A hard inquiry could lower your scores by a few points, or it may have a negligible effect on your scores. In most cases, a single hard inquiry is unlikely to play a huge role in whether you’re approved for a new card or loan. And the damage to your credit scores usually decreases or disappears even before the inquiry drops off your credit reports for good (hard credit checks generally stay on your credit reports for about two years).

That doesn’t sound so bad, but you may want to think twice before applying for a handful of credit cards at the same time — or even within the span of a few months. Multiple hard inquiries in a short period could lead lenders and credit card issuers to consider you a higher-risk customer, as it suggests you may be short on cash or getting ready to rack up a lot of debt. So consider spreading out your credit card applications.

How many hard inquiries is too many?

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but it’s unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders — and in effect, credit-scoring models — look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when you’re shopping for specific types of loans, like car loans, student loans or mortgages.

Learn more about minimizing the effect of hard inquiries below.

What is a soft inquiry?

Soft inquiries (also known as “soft pulls” or “soft credit checks”) typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries won’t affect your credit scores. (They may or may not be recorded in your credit reports, depending on the credit bureau.) Since soft inquiries aren’t connected to a specific application for new credit, they’re only visible to you when you view your credit reports.

Will checking my own credit scores result in a hard inquiry?

No. This is reported as a soft credit check, so it won’t lower your scores. You can check your VantageScore 3.0 credit scores from two major credit bureaus, Equifax and TransUnion, for free at Credit Karma as often as you like without affecting your credit scores.

Examples of hard credit inquiries and soft credit inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didn’t, it should be reported as a soft inquiry.

Let’s look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Common hard inquiries

- Mortgage applications

- Auto loan applications

- Credit card applications

- Student loan applications

- Personal loan applications

- Apartment rental applications

Common soft inquiries

- Checking your credit score on Credit Karma

- “Prequalified” credit card offers

- “Prequalified” insurance quotes

- Employment verification (i.e., background check)

Keep in mind, there are other types of credit checks that could show up as either a hard or soft inquiry. For example, utility, cable, internet and cellphone providers will often check your credit.

If you’re unsure how a particular inquiry will be classified, ask the company, credit card issuer or financial institution involved to distinguish whether it’s a hard or soft credit inquiry.

Dealer Hits On Soft 17 Good Or Bad Guys

How to dispute hard credit inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, you’ll want to look into it and understand what’s going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If you’ve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If you’ve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

How to minimize the effect of hard credit inquiries

When you’re buying a home or car, don’t let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries, like those for mortgage or auto, are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loans (again, like mortgage and auto) as a single inquiry as long as they’re made within a certain window. This window is typically about 14 days.

While some lenders can rely on scoring models that give you more time to shop without incurring an additional hard inquiry, you may want to stick to 14 days to do your comparison shopping, since you likely won’t know which scoring model a lender relies on to generate your score.

Next steps

Your credit scores play a big role in your financial well-being. Before applying for credit, take time to build your credit scores. With stronger credit, you may improve your chances of being approved for the financial products you want at the best possible terms and rates.

Avoid applying for multiple credit cards within a short amount of time. While one hard inquiry may knock a few points off your scores, multiple inquiries in a short amount of time may cause more damage — unless you’re rate-shopping for a home or car, in which case you’ll likely have a grace period to shop around.

To help you keep track of hard inquiries that may influence your credit scores, check your credit reports from Equifax and TransUnion at Credit Karma.

Dealer Hits On Soft 17 Good Or Bad

Related Articles

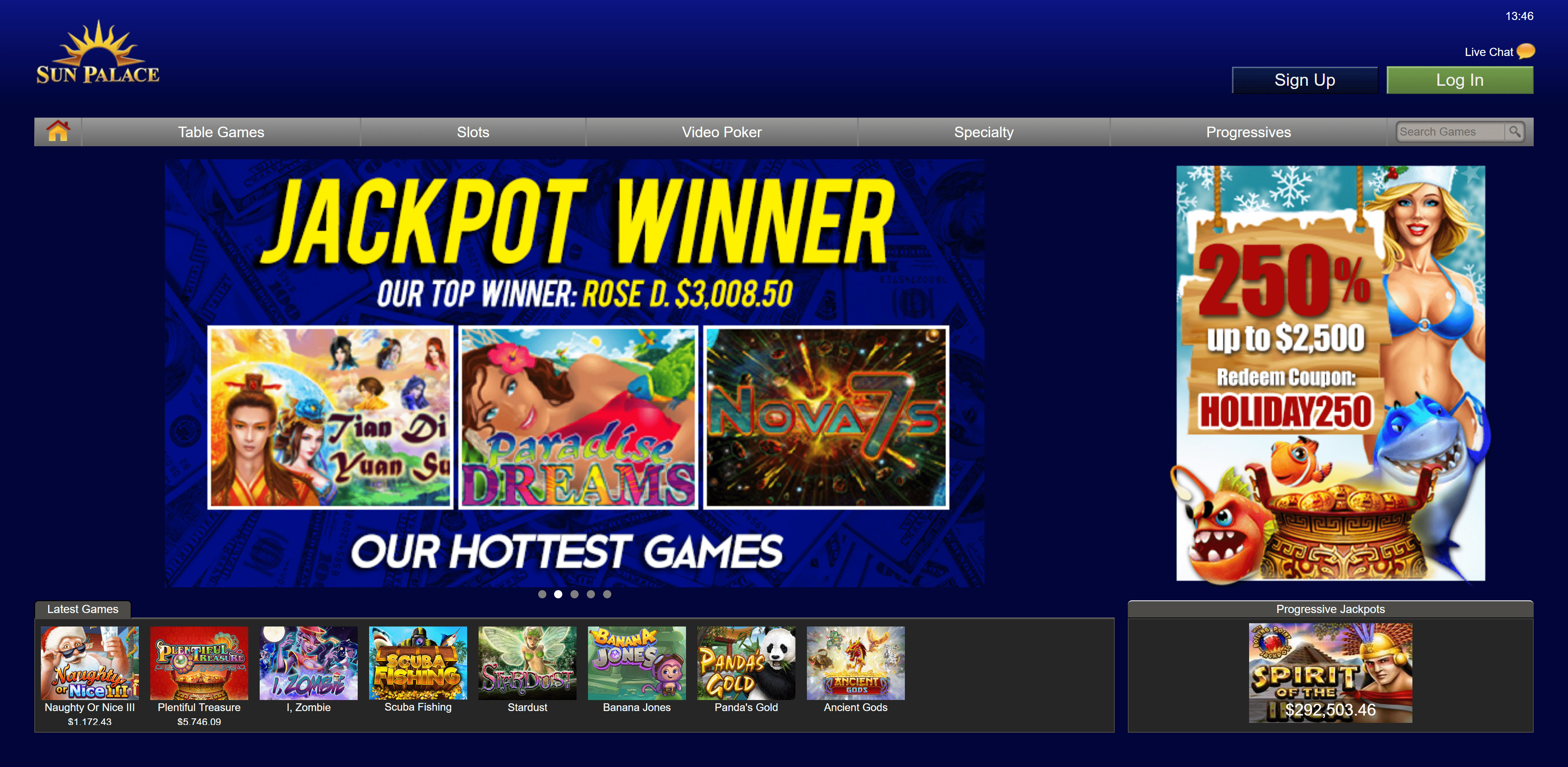

Multi-Deck blackjack is played with four decks or more andand this Basic Blackjack Strategy Chart below is where the dealer will hit on soft 17.

Dealer Hits On Soft 17 Good Or Bad Credit Loans

Each casino may use a slightly different version of the rules for multi-deck blackjack. Take the time to get to know the rules and game strategy before beginning to play, no matter whether your goal is to become a professional card sharp or to enjoy a few hours’ of entertainment at the casino table.

According to some casino rules, the dealer hits on soft 17. Soft 17 is a blackjack hand made up of a Six and an Ace which is being counted as 11 points. Any other combination that adds up to a value of 17, for example Ten plus Seven, is called “hard 17.”

To determine whether a dealer hits on soft 17, look at the blackjack table layout. There you will see written one of 2 alternatives, either: “Dealer Hits Soft 17” or “Dealer Must Stand on all 17.” With the soft 17 rule, the house will have an edge that is a bit higher than otherwise.

Click for information on history, how to play, terminology/glossary, table layout and blackjack card counting.